ICICI Home Loan Interest Certificate: Steps to download it online

Table of Content

The ICICI Home Loan Statement will be issued by the bank only after the home loan is approved. The home loan borrowers need to keep checking the status of the application process. Therefore, to make this purpose easier and online service facility has been provided to the customers. It is issued at the end or beginning of each financial year indicating the remaining home loan EMI left to be paid.

It neither warrants nor is it making any representations with respect to offer made on the site. It is advisable that only the ICICI Bank Home Loan applicant or co-applicant visits the branch for procuring these specific documents. Once you log in following the above steps, you will be able to access and download your ongoing home loan interest certificate.

Loan EMI calculation on iMobile

I was skeptical at first, since it is generally not easy to get things done online in India. To my surprise, the entire home loan process was very quick and I had constant support and help from my relationship manager. There was no over-promising of any sorts and he cleared all my doubts with patience. Being an NRI, I found it was really helpful having Krishna readily available to guide and support me with any queries. He was very professional in his conduct and proactive in answering my queries.

I wanted to recognise ICICI Bank Home Loan team and BCM Karthikeyan for all the support extended in meeting our set deadline of registering the property on 6th May. The conversation with you and the branch manager followed by the experience has reposed out faith in ICICI Bank as a result we would be moving more family accounts to the ICICI Bank Branch. Pay your bills, shop online and make payment to any merchant unified payments interface ID easily and instantly. Magicbricks is only communicating the offers and not selling or rendering any of those products or services.

Can I download my ICICI Bank home loan statement online?

The Turnaround Time for mortgage loan prepayment statement issuance has been revised from existing 7 days to fifteen 15 days. The bank has its internal eligibility criteria for home loans such as the salary, type of job, company, the type of job and work experience, etc. The ICICI Bank home loan eligibility calculator is also on the bank website. The following are the necessary criteria that help in determining the individual’s eligibility when applying for a home loan.

He can also request for a provisional certificate but remember the provisional loan certificate will not be available for partial loan disbursement. A house loan statement is a statement issued by the lender of the home loan borrower stipulating the principal and the interest amount repaid by him in a financial year. It acts as a borrower’s repayment proof and is of utmost importance especially in foreclosing a home loan via home loan balance transfers. Since the statement shows the latest outstanding home loan balance as on date, tracking of monthly/yearly repayments towards the home loan becomes quite easy for a borrower.

Interest Certificate / Home Loan Statement?

It is fairly easy to get a Home Loan statement from ICICI Bank online. Click on “PDF” to create and download the home loan statement after entering the account number and the time frame for which you need to review your statement. Complete all fields, including those for the applicant’s date of birth, email address, other pertinent contact information, and the home loan account number.

This makes it easier for the consumer to remember the amount and duration of each repayment. The requirements for ICICI Bank home loans are not particularly difficult to meet. The bank’s only focus is on determining the borrower’s capacity to repay the loan, while the candidate’s monthly disposable and surplus income is a crucial factor in determining their ability to repay the loan.

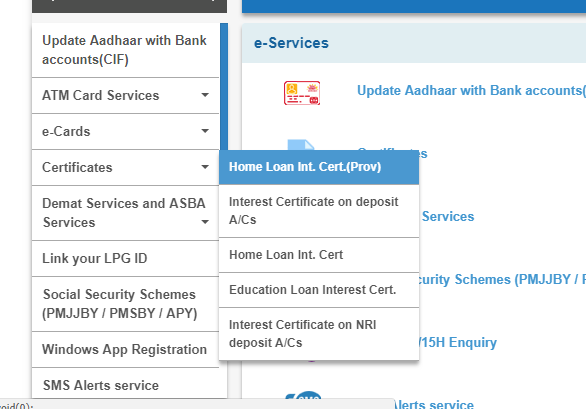

How to Download ICICI Home Loan Statement from ICICI

The information collected would be used to improve your web journey & to personalize your website experience. Explore a vast database of 40K+ ICICI Bank approved projects by leading developers, across 44 locations in India. Fill all the necessary details, such as Home Loan Account Number, Applicant’s Date of Birth, Email ID and other contact details as applicable. With effect from November 20, 2022, new Mortgage Loan charges are being introduced.

So, I contacted Mr Jainam Shah of ICICI Rajkot Branch and gave him all the required details. We determine your eligibility after considering various factors, including your monthly income, your monthly financial obligations, your current age and your retirement age, among other things. To apply for a home loan, you need to submit documents such as a proof of identity, a proof of address, a loan application form that has been duly filled and your financial documents.

The best scheme depends on the need and credit background of the applicant. In case of application rejection, the applicant will receive a rejection letter stating the reasons for the rejection of the application. In the final level, the home loan interest and tenure are both fixed. The bank will also do a background check to verify the customer’s home and professional information. A bank representative will collect your documents either form your home or office for verification.

Identity verification, address proof, and income proof are the three main papers needed for a house loan. Remember to follow the following steps to obtain the HDFC home loan certificate of interest/HDFC home loan statement. The statement shows the outstanding due amount, balance home loan tenure, upcoming home loan EMIs and the amount paid, thus helping the borrower to track his home loan activities. You can visit any ICICI Bank branch and request for a copy of the home loan statement. Those who have applied for a home loan with ICICI Bank, will also be able to track the status of their application by following certain easy steps. Among the multiple account numbers that might appear in the drop-down, you have to select the account number and the period for which you need the statement.

So, rate of interest of your housing loan changes in line with the Repo Rate. As a result, the EMI or the tenure of your loan will increase or decrease, depending on the change in the rate of interest. However, a Provisional Interest Statement is available before the end of the current financial year as well, if required. This mentions the total interest payable on the ICICI Bank Home Loan during that particular financial year. This is usually required for planning income tax and other finances for the financial year.

Utilising a computer, smartphone, or laptop to submit an application for a home loan assures quick approval. Ii) The borrower will be redirected to the above page requiring him to submit the necessary details namely the loan account number, DOB , loan amount, EMI amount & the account number. It provides the EMI break-up of the interest paid and the principal repaid by the borrower, easy enough for the borrower to track his repayments. Total interest paid, type of home loan interest rate i.e. floating/fixed home loan rates and the applicable interest rate.

As the public lender has launched an array of digital initiatives, it hopes to source 75% of its new home loans digitally, in the next few years. As it is, ICICI Bank’s mortgage loan portfolio has crossed Rs 2 trillion. While nearly one-third of the new home loans are sourced digitally, the bank expects this number to reach three-fourths of new home loans in the next few years. The bank has made significant investments, to to simplify the online processing for one of the most complex financial products, i.e., home loans.

I would like to highlight that the loan request I placed was addressed well within time and you have been constantly in touch with me to ensure that the home registration date must be adhered to. I would gladly recommend and endorse your and ICICI Bank Home Loan service to all my friends and acquaintances who may be in need of them. A fixed rate of interest on a home loan means that the rate of interest does not change throughout the tenure of the loan. The EMI is calculated on the basis of specific factors like the amount of the loan, its tenure and the rate of interest. The ICICI Bank Home Loan statement and interest certificate can be fetched offline as well.

Comments

Post a Comment